The mobile money market is booming in Somalia. Approximately 155 million transactions, worth $2.7 billion or 36% of gross domestic product (GDP), are recorded every month. Mobile money accounts for a high proportion of money supply in the domestic, dollarized economy and has superseded the use of cash; seven out of 10 of Somalis use mobile money services regularly.

The mass adoption of mobile money raises concerns about the magnitude of system vulnerabilities, and potential macroeconomic effects in cases of disruptions – with potentially serious implications on the wider economy. As we explore in the latest Somalia Economic Update (SEU), customers have no guarantee that their e-money can be redeemed for cash, as there is no parity requirement between monetary value held virtually on the mobile money wallets and physical funds held on deposit. Know-your-customer (KYC) data used to identify clients and determining the risks of illegal intentions, is not systemically registered for mobile money wallets, and there are no formal frameworks to protect consumers in dispute cases. The lack of regulatory and supervisory oversight of mobile money services is a source of added concern.

Mobile money experiences, especially those concerning the protection of consumer rights, have been stifled throughout the reporting period.

So how can Somali authorities protect consumers? The challenge for policymakers and regulators is how to introduce mobile money regulations on a market that has operated without regulatory oversight. Ensuring stability and reliability of the mobile money system is a priority, focusing on safeguards for consumer funds, improving compliance and risk management, reducing opportunities for fraud, strengthening regulatory reporting, and protecting consumer data.

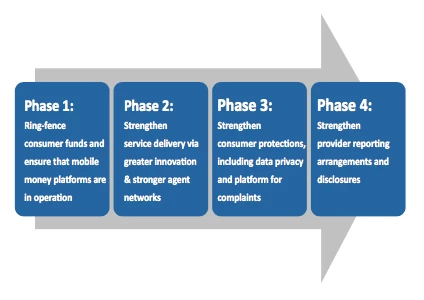

In the SEU, we recommend a phased-in approach for regulating mobile money services. The top priority must be to safeguard consumer funds and ensure continued and undisrupted service delivery. The second priority should be to strengthen service delivery via greater innovation, including stronger agent networks, internal controls, and holding providers responsible for agents. Once the protection of consumer funds and service delivery are guaranteed, it will be important to strengthen consumer protections, including data privacy, and create platforms for complaints and access to redress mechanisms. Regulation could then address the requirement for clear, consistent, and effective reporting and disclosures from providers.

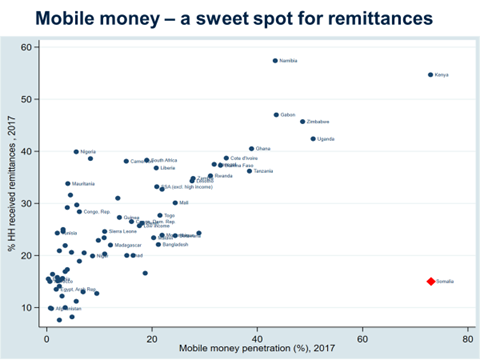

Mobile money services that are regulated and supervised provide opportunities for securely and responsibly expanding financial inclusion. This is amplified by the use of mobile money to transfer more than a billion dollars as remittances to Somalia. Regulation of mobile money is likely to promote greater financial stability and integrity, level the playing field, and boost the system’s usefulness for more advanced applications. Balancing regulatory oversight with space for private sector innovation using the so called “regulatory sandbox,” would allow regulation to keep up with innovation, and could increase the functional utility of mobile money.

Somalia’s mobile money services need to be adequately regulated before serving as a critical enabler for innovation and anchor of financial sector development. A digitized identification system and social protection mechanisms are just two of many examples where innovation backed by financial technology (fintech) can contribute to financial inclusion, equity and resilience.

Join the Conversation